san francisco payroll tax and gross receipts

Therefore when you register for a San Francisco Business License you will become obligated for these local taxes. 1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax.

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

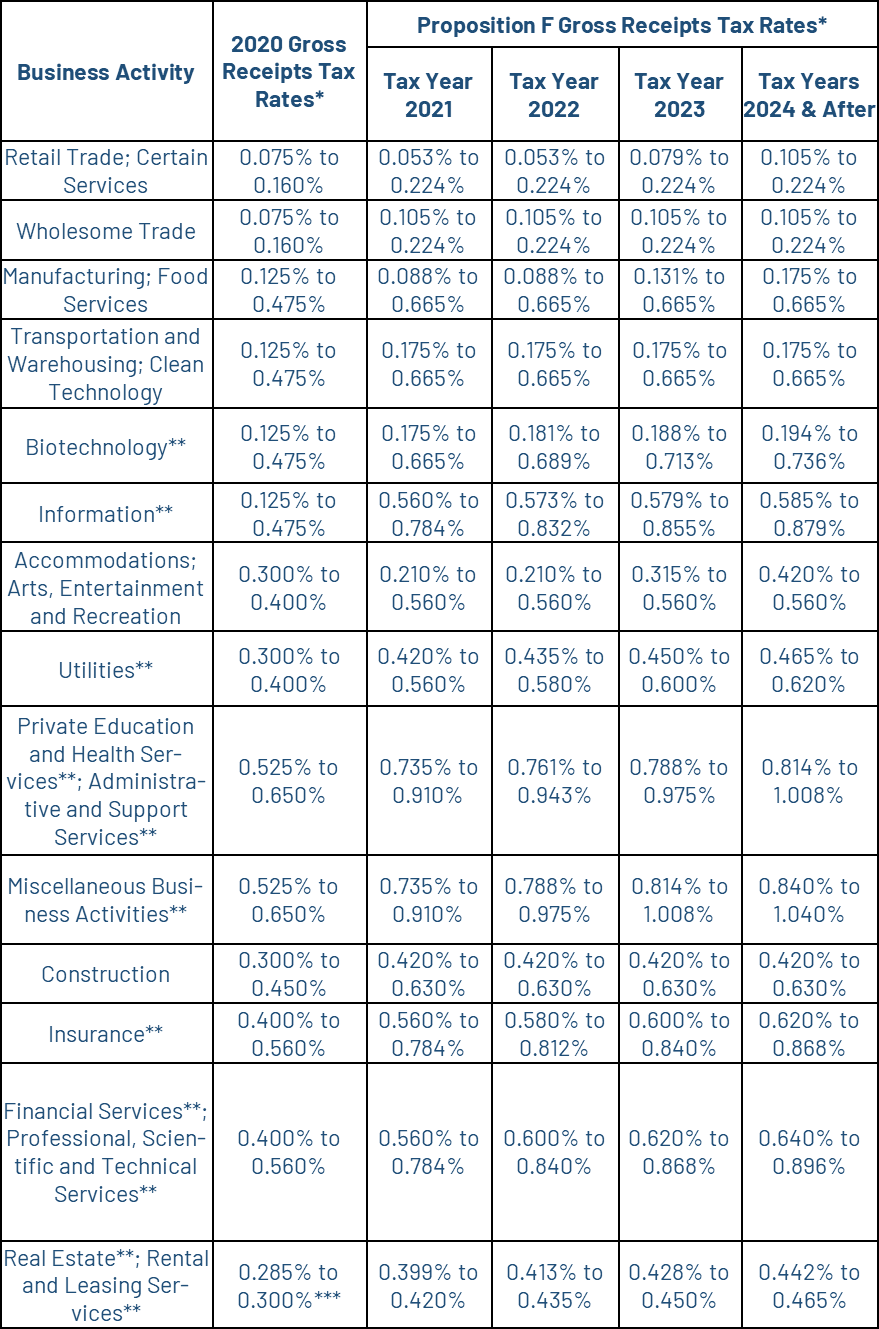

If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the.

. In November of 2020 San Francisco voted to. Gross receipts and payroll taxes. Proposition F fully repeals the Payroll Expense.

The City began making the transition to a. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes.

Beginning in 2014 the calculation of the SF Payroll Tax changes in two significant ways. The citys gross receipts tax which remains a stealth payroll tax for most companies will become especially confounding as remote work grows. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

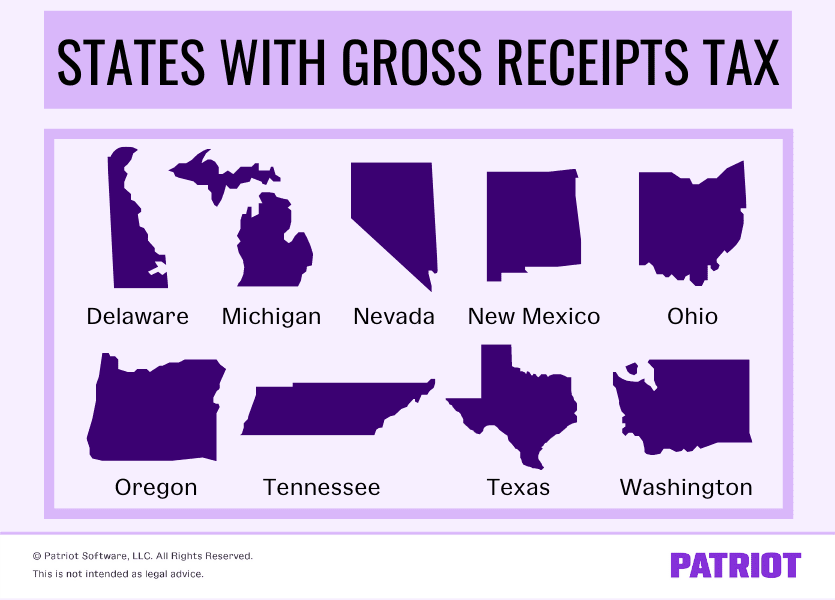

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. Until 2018 all businesses with a. The Gross Receipts Tax is a graduated percentage depending on the activity code your business falls under in the NAICS system.

From imposing a single payroll tax to adding a. All groups and messages. The 2021-22 San Francisco Business Registration Renewal due date has been.

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. Starting with a single payroll tax weve seen a transi. The Gross Receipts Tax has a small business.

Beginning in tax year 2014 for five years the San Francisco payroll expense tax rate will be incrementally reduced and the gross receipts tax rate will be. Since 2012 San Francisco has undergone many changes with its taxation of payroll and gross receipts. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on the gross receipts tax of up to 6.

Taxpayers Reminded San Francisco Gross Receipts Tax And Payroll Expense Tax Due On Feb 29 2016 Corporate Tax United States

Ghj California Understanding The Tax Burden

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

Prop F San Francisco S Sweeping Business Tax Overhaul Wins Big

San Francisco S Tax On Big Business Is A Warning For Tech Quartz

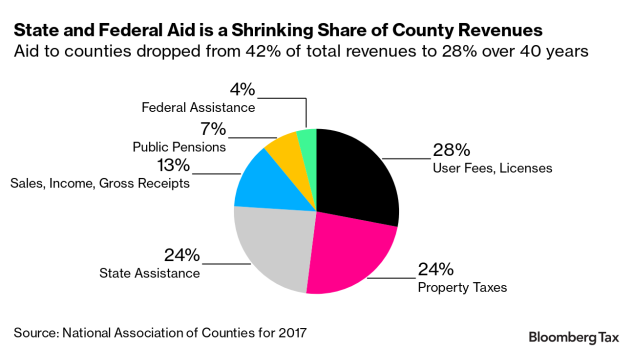

Revenue Squeeze Pushes Cities Counties To Get Creative On Taxes

Annual Business Tax Returns 2020 Treasurer Tax Collector

Gross Receipts Tax Gr Treasurer Tax Collector

Oakland Taxes The City May Ask Voters To Overhaul Business Tax Structure

San Francisco Business Registration Fact Sheet Pdf Free Download

How Much Proposition E Will Save Sf Startups Funwithmath Techcrunch

Measure U Gross Receipts Business Tax Richmond Ca Official Website

Employee Retention Tax Credit Ertc San Francisco

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

San Francisco Gross Receipts Tax

Multnomah County Voters Reject Metro Payroll Tax Approve Universal Preschool Measure Kbf Cpas